Credit Repair Friendswood: Your Path to Financial Healing

Wiki Article

Mastering Credit Score Repair: Professional Tips and Insights for Elevating Your Credit Rating

Are you battling to enhance your credit rating? Look no better. In this short article, we will supply you with specialist ideas and understandings on grasping credit report repair service. We will certainly assist you via understanding credit report and records, determining and challenging errors, methods for repaying financial obligation, and structure positive credit report. And also, we will certainly help you navigate the globe of credit report repair service solutions, so you can choose the right choice for you. Elevate your credit report with our professional advice.Comprehending Credit Score Ratings as well as Reports

Understanding your credit score is essential for enhancing your economic health. Credit repair Kemah. Your credit history is a three-digit number that represents your credit reliability. It is a representation of how responsible you are with your credit score and also how likely you are to settle your financial obligations. By recognizing your credit history rating, you can take the essential steps to enhance it and also open up possibilities for much better monetary choicesYour credit rating rating is determined by several factors, including your payment background, credit rating application, size of credit scores history, types of credit report, as well as brand-new credit report inquiries. Payment history, which represents about 35% of your credit report, describes your track record of making prompt settlements on your financial obligations. Credit scores usage, which accounts for about 30% of your credit history, is the proportion of your superior credit balances to your readily available credit score.

In order to fully recognize your credit rating, it is very important to on a regular basis examine your credit report reports. Your credit score records have in-depth info about your credit report, including your open as well as shut accounts, payment history, as well as any type of adverse info such as insolvencies or collections. By evaluating your credit score reports, you can recognize any kind of mistakes or inaccuracies that may be negatively influencing your credit report.

Recognizing and also Contesting Mistakes on Your Debt Report

Identifying and resolving mistakes on your credit record can assist boost your general economic wellness. It's vital to regularly review your credit score record to guarantee its precision. Begin by inspecting for any type of inaccurate personal information such as your name, address, or social security number. These mistakes can possibly bring about identity theft or incorrect identification, which can seriously influence your credit rating. Next, analyze the account information area of your record. Look for any accounts that you do not recognize or any late repayments that you think were made promptly. These mistakes can drag down your credit rating and also ought to be challenged immediately. Bear in mind to gather any kind of supporting documentation that proves the mistakes on your report. It's time to take action as soon as you've identified the errors. Get in touch with the credit scores coverage agency and offer them with a thorough description of the mistakes in addition to the sustaining records. They are legitimately obligated to solve the issue as well as explore within a specific duration. By taking the necessary steps to contest mistakes on your credit score record, you are taking control of your monetary future and also functioning towards a far better credit rating.Approaches for Settling Debt and Taking Care Of Credit Report Use

To efficiently manage your financial debt and debt utilization, it's important to create a budget that permits you to assign funds towards repaying your superior equilibriums. Producing a spending plan assists you obtain control over your finances and also ensures that you are making development in the direction of eliminating your financial obligation. Start by detailing all your incomes and also then track your expenditures for a month to obtain a precise image of your costs habits. Identify areas where you can reduce and also allocate those cost savings in the direction of settling your financial obligation. It is very important to prioritize your payments by concentrating on high-interest debts initially, as they can swiftly accumulate and become unmanageable. Think about settling your debts into a solitary funding with a reduced rate of interest price, as this can make it easier to settle your equilibriums. Another approach is to bargain with financial institutions for reduced rate of interest prices or a settlement plan that fits your financial situation. Remember to constantly make your payments in a timely manner to stay clear of extra costs as well as penalties. By adhering to these approaches and also staying with your spending plan, you can take control of your financial debt and boost your credit history application.Structure Positive Credit Rating as well as Improving Your Score

Another strategy to enhance your credit report rating is to keep your credit history try this website usage ratio reduced. This proportion is the amount of credit score you are making use of compared to your total readily available credit scores. It's ideal to keep this proportion listed below 30% to prevent negatively affecting your score. Regularly checking your credit scores record is additionally necessary. Look for any errors or mistakes that can be dragging your rating down. Be certain to dispute them with the credit rating bureaus to have them remedied if you discover any mistakes. Avoid opening up also lots of brand-new credit rating accounts at when. Each brand-new account can temporarily reduce your rating, so it's ideal to only open up new accounts when needed. By adhering to these suggestions, you can slowly build a positive credit report background as well as enhance your credit history.

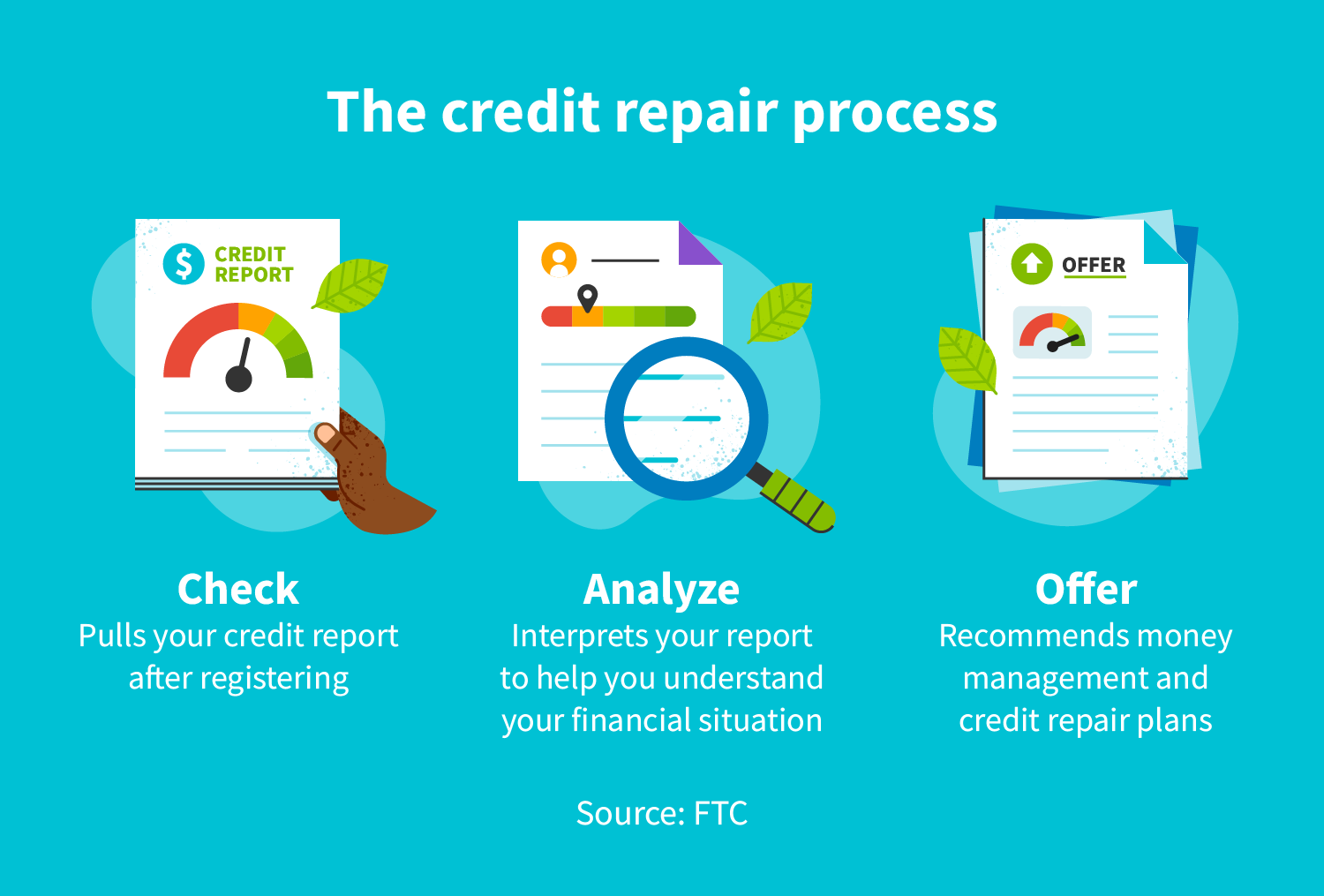

Navigating Credit Report Repair Providers: Exactly How to Select the Right Option

When selecting a credit scores repair service, it is necessary to research study different options and also consider their online reputation as well as performance history. You wish to make sure you're working with a company that has a proven record of success in assisting people improve their credit report. Beginning by searching for evaluations as well as testimonials from previous clients. This will offer you a suggestion of the experiences others have actually had with the solution.Another vital aspect to consider is the business's track record. Seek a credit scores fixing service that is approved as well as has a good standing with organizations such as the Better Business Bureau. This will provide you assurance understanding you're collaborating with a credible firm that follows honest practices.

It's likewise worth taking into consideration the services supplied by the credit report repair business. Some business might use a one-size-fits-all technique, while others might offer customized strategies based upon your details needs. Try to find a solution that supplies a customized approach to credit scores repair service, as this will certainly increase your chances of success.

Last but not least, do not neglect to ask about the cost of the solution. While credit score repair work solutions can be valuable in boosting your credit report, they can likewise be costly. See to it you comprehend the charges involved and also what services are consisted of before choosing.

Verdict

Finally, you've learned beneficial ideas and insights to grasp credit repair work and elevate your credit history. By comprehending credit rating as well as reports, identifying as well as disputing errors, and strategically managing your debt as well as credit use, you can make significant improvements. Building favorable credit report and selecting the appropriate credit repair service solutions will certainly further enhance your monetary standing. Keep in mind, with devotion and also understanding, you have the power to take control of your credit report as well as accomplish your economic goals. So begin implementing these specialist techniques today as well as enjoy your credit history rise.Your credit history rating is determined by numerous elements, including your payment history, debt utilization, size of credit score background, kinds of credit, and new credit rating queries. Credit rating use, which accounts for around 30% of your credit history score, is the ratio of your outstanding credit balances to your readily available credit report.

By evaluating your credit history reports, you can recognize any errors or inaccuracies that might be negatively influencing your credit history rating.

In verdict, you have actually discovered valuable tips as well as insights to master credit scores repair and also raise your credit rating score.

Report this wiki page